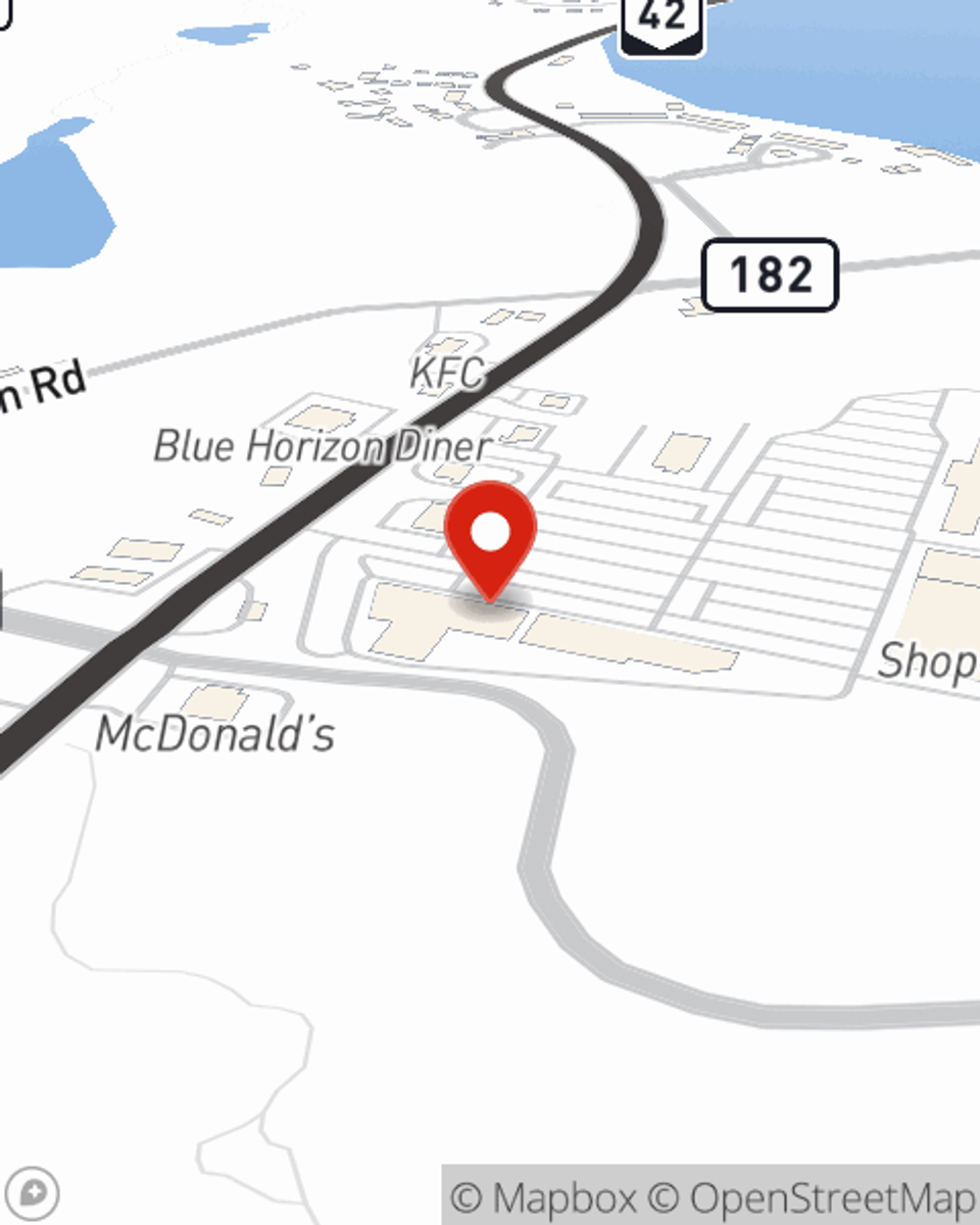

Business Insurance in and around Monticello

Get your Monticello business covered, right here!

This small business insurance is not risky

This Coverage Is Worth It.

Whether you own a a pharmacy, a fabric store, or a window treatment store, State Farm has small business insurance that can help. That way, amid all the various moving pieces and decisions, you can focus on navigating the ups and downs of being a business owner.

Get your Monticello business covered, right here!

This small business insurance is not risky

Insurance Designed For Small Business

The passion you have to serve your customers is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Robert Wells. With an agent like Robert Wells, your coverage can include great options, such as commercial auto, commercial liability umbrella policies and worker’s compensation.

The right coverages can help keep your business safe. Consider visiting State Farm agent Robert Wells's office today to discuss your options and get started!

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Robert Wells

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.